Imagine watching your Tesla stock soar from $100 to $1,000, making you a paper millionaire – but then getting a tax bill before you’ve sold a single share. This isn’t just a hypothetical scenario; it’s at the heart of one of today’s most heated financial debates.

With Kamala Harris’s proposed “billionaire minimum tax” targeting unrealized gains, and tech billionaires like Elon Musk sitting on massive paper wealth, understanding unrealized capital gains has never been more crucial. Before we dive into this proposal, let’s break down what unrealized capital gains actually are – and why they matter to everyone, not just billionaires.

What are unrealized capital gains?

Before we begin, let’s define what unrealized capital gains are.

An unrealized gain is when you have invested in something that has risen in value but haven’t sold it yet. That increase in value — as long as it’s not sold, is unrealized. It is realized the moment you sell it.

For instance, if you are one of the lucky ones who bought Nvidia shares, let’s say 50 of them, at $20/share and it’s now worth $100/share. It has increased $80 since you bought it, and since you have 50 of them, 50 * $80 is $4,000. Your unrealized gains are $4,000.

If you sold your shares, then you realized gains of $4,000.

Unrealized gains are also known as “paper profits” because they only exist on paper. You don’t know the true value of anything until the actual deal goes through. You usually can get a rough idea of a price based on recent similar items being sold. In real estate, you often look at houses of similar size in quality in the neighborhood that have sold recently. In the stock market, the “price” you see for a stock is the last price that a transaction held at, and changes only when a buyer and seller agree on a price.

This is a very important point: the only thing that changes the price of an item is when it is bought or sold. An “unrealized gain” is a guess at how much someone would get if they sold.

If we go back to the economic basis of supply and demand, we will recognize that when there is high demand prices go up, and when there is high supply prices go down. Most large hedge funds can’t buy a significant portion of a given stock without lowering the price of the stock.

When Warren Buffett buys into a company, it often takes months, because if he buys too much, the price shoots up. This works the other way too, when people look at someone’s net worth, like Elon Musk, they are taking the last price and multiplying it by the shares they own. Elon Musk has a lot of Tesla shares. Three-quarters of his “wealth” is in these shares. The problem is? Just like unrealized gains are paper profits, this is paper wealth.

What would happen if he tried to sell all of his shares at once? The price of Tesla would drop, dramatically.

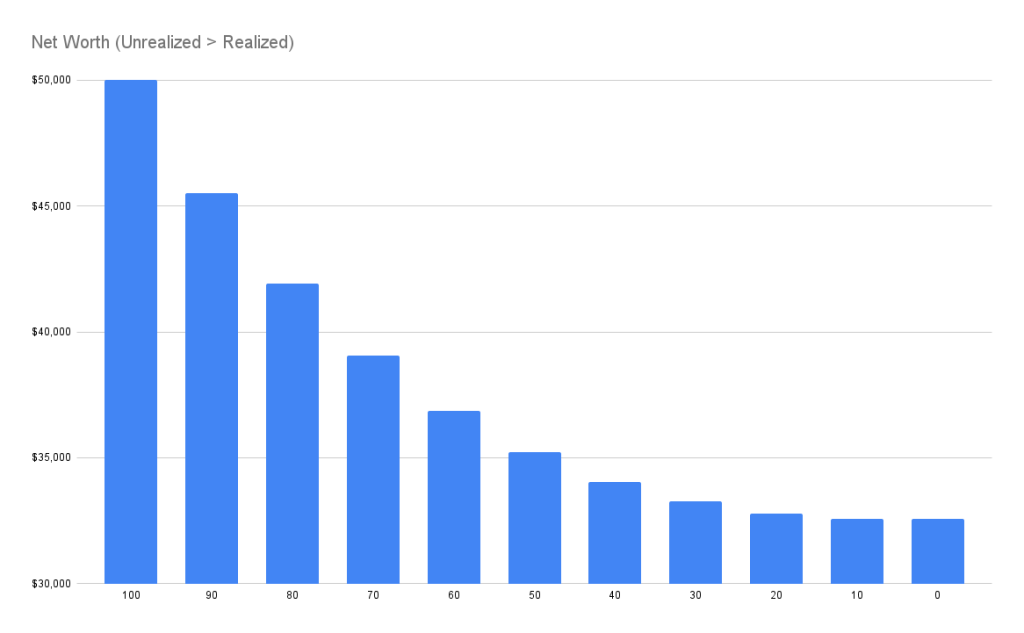

Let’s use a fictional example and imagine that Bob has 100 shares of a company at $500/share. This means his net worth is 100 * $500, or $50,000. Now imagine for every 10% of his shares that he sells, that the price drops by 10% (this only happens if you have enough shares to move the market, which is true when talking about the very wealthy or hedge funds).

To see the step-by-step of this chart, consult this table:

| Shares Sold | Last Price | Unrealized Net Worth | Realized Net Worth | Shares Owned |

| 0 | $500 | $50,000 | $0 | 100 |

| 10 at $500 | $450 | $40,500 (90 * $450) | $5,000 | 90 |

| 10 at $450 | $405 | $32,400 (80 * 405) | $9,500 | 80 |

| 10 at $405 | $365 | $25,515 (70 * $365) | $13,550 | 70 |

| 10 at $365 | $328 | $19,683 (60 * $328) | $17,195 | 60 |

| 10 at $328 | $295 | $14,762 (50 * $295) | $20,476 | 50 |

| 10 at $295 | $266 | $10,629 (40 * $266) | $23,428 | 40 |

| 10 at $266 | $239 | $7,174 (30 * $239) | $26,085 | 30 |

| 10 at $239 | $215 | $4,305 (20 * $215) | $28,477 | 20 |

| 10 at $215 | $193.7… | $1,937 (10 * $194) | $30,629 | 10 |

| 10 at $194 | $174 | $0 | $32,566 | 0 |

While this is a fictional example, it shows that his realized value ($32,566) is nearly 40% less than the projected paper wealth (unrealized net worth) he had at the beginning. The amount that a stock is likely to drop varies by the stock so there’s no standard method to determine how much a stock would drop, but we do know it happens with big investors.

Why does taxing unrealized gains matter?

It’s important to understand the role of taxes. At a fundamental level, it’s to pay for services and utilities for the common good of the people. It can also be used to penalize people, businesses, governments, or countries (often in the form of tariffs). It is also used to incentivize people to do various behaviors that the government thinks are beneficial.

The power of these small (or sometimes large) incentives is shown thoroughly in Nudge by Richard Thaler, Nobel Prize-winning behavioral economist.

Let’s look at a similar issue, the taxing of short-term vs long-term capital gains. When most people talk about their tax bracket, that’s standard income and is the same as short-term capital gains.

Here’s the 2023 income bracket range, the same as short-term capital gains.

| Tax rate | on taxable income from . . . | up to . . . |

|---|---|---|

| 10% | $0 | $11,000 |

| 12% | $11,001 | $44,725 |

| 22% | $44,726 | $95,375 |

| 24% | $95,376 | $182,100 |

| 32% | $182,101 | $231,250 |

| 35% | $231,251 | $578,125 |

| 37% | $578,126 | And up |

Long-term capital gains, or investments that were held for more than a year have the following tax bracket in 2024:

| Tax rate | Single | Married filing jointly | Married filing separately | Head of household |

|---|---|---|---|---|

| 0% | $0 to $47,025 | $0 to $94,050 | $0 to $47,025 | $0 to $63,000 |

| 15% | $47,026 to $518,900 | $94,051 to $583,750 | $47,026 to $291,850 | $63,001 to $551,350 |

| 20% | $518,901 or more | $583,751 or more | $291,851 or more | $551,351 or more |

Taxing unrealized capital gains would work as an incentive to spend money rather than save money because you no longer have an advantage in keeping it invested.

Why do governments generally want to incentivize saving money?

First reason: stabilize and build wealth

Think of personal savings like a city’s walls in medieval times – the stronger they are, the better they protect against disasters.

It’s hugely advantageous for a population to be able to support themselves through emergencies. Recent polls show that the median American only has about $600 saved away for emergencies, a dismal state for anyone to be in. This is essentially living paycheck-to-paycheck and means that if anything goes wrong, they will be without necessities or they will be living in a degree of poverty.

When this happens, these people often go to their local government seeking aid, whether that’s food, social security, unemployment, housing, and so on. It’s a tremendous burden. It also means that person is no longer contributing as much to their community as they struggle with their problem.

When you have a high savings nest egg, most FIRE communities suggest 6-month of expenses, you can weather many storms, both for you personally and for the state. This also leads to eventual wealth creation, and having a strong middle class is important for all nations.

Second reason: support the local economy

Your savings account isn’t just sitting there – it’s like a battery powering your local economy.

One thing that naturally happens after people have sufficient savings is investing in their local economy. Small businesses and large, and often contribute to a virtuous upward spiral of an economy. As businesses get more investment, they can hire more people, who add more value to the economy.

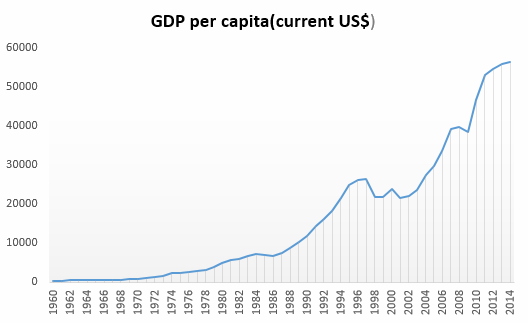

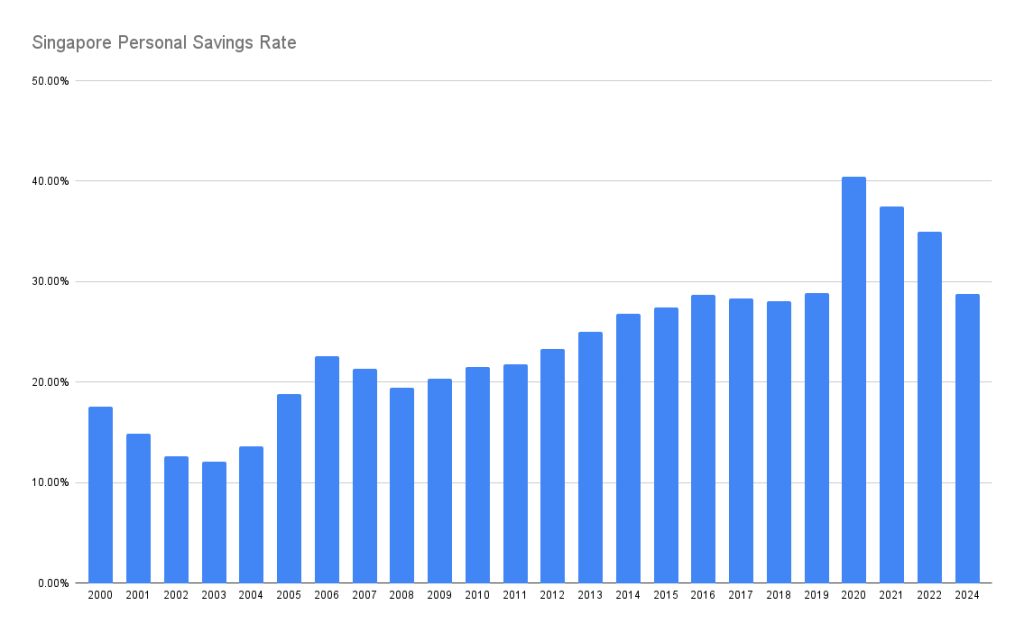

Nations often use GDP per capita as a success metric, something that shows them the country is doing well. This is a rough measure of the amount of value created in a country per person. While it hasn’t been fully proven, there have been many studies showing the link between savings rate and GDP per capita, supporting the hypothesis that a higher personal savings rate correlates with a higher GDP.

As I showed in my article How much money should you save each month?, the US is around a measly 4% savings rate, while countries like Japan are closer to 50%.

Singapore as a case study

From fishing village to one of the wealthiest-per-capita nations, Singapore’s transformation over 60 years tells a powerful story about savings and economic growth.

Lee Kuan Yew, former Prime Minister of Singapore is considered one of the world’s best national builders and an excellent example to follow. He has served as a mentor to many Chinese leaders to American presidents. Singapore wasn’t much more than a fishing village in the 50s with incredibly low GDP per capita, and in the last 60-70 years has increased it to one of the highest out of all countries. Here’s a graph from 1960 to 2014:

When you look at the top 10 countries as of 2022, they rank #2, while the US ranks #8!

| # | Country | GDP per capita (2022) |

|---|---|---|

| 1 | Luxembourg | $142,214 |

| 2 | Singapore | $127,565 |

| 3 | Ireland | $126,905 |

| 4 | Norway | $114,899 |

| 5 | Qatar | $114,648 |

| 6 | United Arab Emirates | $87,729 |

| 7 | Switzerland | $83,598 |

| 8 | United States | $76,399 |

| 9 | Denmark | $74,005 |

| 10 | Netherlands | $69,577 |

Let’s look at Singapore’s savings rate over the last 20 years:

This certainly isn’t the only reason that Singapore is doing so well, but I think it’s an important part, and the fact that the US is so low in this area already would indicate that we want to incentivize saving money.

Oh, and in case you’re wondering, Singapore has no capital gains tax at all.

What problem is sparking Kamala’s bill to tax unrealized gains?

This brings us to Kamala Harris’ bill to tax unrealized gains.

In short, this bill only affects those who have $100 million in wealth or more and taxes their unrealized gains on all their assets. Let’s look at the potential reasons behind the bill.

Tax the rich

If you haven’t heard of it, “tax the rich” is a movement aimed at getting the wealthy and large corporations to pay their fair share of taxes. The movement points to 55 large corporations that managed to pay no federal income tax (usually due to clever accounting and business losses) as a method that the rich are using to avoid paying tax.

Kamala’s bill has also been named the “billionaire minimum tax”. Considering that many of those that would be affected pay an effective tax rate of only 8% (compared to the middle class which is closer to a 25% effective tax rate).

I absolutely agree that tax avoidance and tax loopholes should be closed, and I think Warren Buffett says it well in his NY Times opinion piece, “Stop Coddling the Super-Rich.” He has also gone further to say that he hopes and expects to pay much more taxes in the future:

“At Berkshire we hope and expect to pay much more in taxes during the next decade. We owe the country no less: America’s dynamism has made a huge contribution to whatever success Berkshire has achieved – a contribution Berkshire will always need. We count on the American Tailwind and, though it has been becalmed from time to time, its propelling force has always returned.”

Warren Buffet, Berkshire Hathaway Annual Report 2022

With all that said, taxing unrealized gains is entirely different. One of the big issues is the volatility of unrealized gains. The price of a stock or asset can increase by 20% in one quarter and drop by 20% the following quarter. Later in the same annual report, Warren Buffett mentions how misleading it is to investors to report unrealized gains:

“[unrealized] earnings are 100% misleading when viewed quarterly or even annually. Capital gains, to be sure, have been hugely important to Berkshire over past decades, and we expect them to be meaningfully positive in future decades. But their quarter-by-quarter gyrations, regularly and mindlessly headlined by media, totally misinform investors.”

Warren Buffet, Berkshire Hathaway Annual Report 2022

Lower the deficit

Harris has proposed several different tax proposals and combined they’re expected to “save” $4 trillion dollars over the next decade. Save is in quotes because it’s not saving anything, it’s all tax. While this is useful, it’s important to note that the US would still have a deficit, and she is implementing other programs that require an increase in the deficit.

Deficit vs Debt

The deficit is the amount of money the US spends in a single year beyond it’s revenue. It’s the amount that contributes to the US National Debt.

The debt is the total amount, accumulated over years, that we owe to other parties (goverments, countries, etc.) Each year the debt increases by the deficit.

This means we’re not going to get any closer to balancing our budget, it just means we’re going to slow down how bad it gets. She’s still increasing the deficit through her other efforts.

Unrealized gains as assets

This is the largest problem with unrealized gains in my opinion, and probably deserves its own post. Up above I explained in detail how unrealized gains are paper profits and not necessarily real profits. That is, in part, why we haven’t taxed them before. We’re saying “Don’t count this as money until you sell it.”

Then why can we treat unrealized gains as collateral? You can ask a bank for a loan and say “If I fail to keep up my payments, you can keep this stock.” Now, unrealized gains have actual value. If this seems antithetical to everything else I’ve been describing, I’m right there with you.

Using our example earlier, Elon Musk was able to purchase Twitter (and many other things) through this exact method. In fact, you can see in an SEC filing he has put up 238,000,000 shares as collateral for various loans.

Harris’s bill doesn’t address this at all, but it’s clearly a problem. Her tax might be a round-a-bout way of attempting to address this, but the problem is different than what’s being addressed.

Unrealized gains should not be able to be used as collateral.

One approach that could work is that you are immediately taxed on unrealized gains if you do use it as collateral.

The other tax loophole here is that loans and loan repayments aren’t considered tax! In normal conditions this makes sense, you put something up for collateral that you have already paid for with income that has already been taxed. In this case, you get money that won’t be taxed from money that hasn’t been taxed.

Practical concerns in taxing unrealized gains

Picture trying to tax a rainbow – beautiful to look at, but impossible to grab. That’s similar to the challenge of taxing unrealized gains. While the concept might sound straightforward, the implementation faces several serious hurdles.

Everything so far has been understanding what unrealized gains are, how it’s taxed, its history, why it’s important, and what Harris’s bill tries to address. The last part addresses the practicality of trying to implement taxing unrealized gains, and the article Unrealized Capital Gains Tax is “Capital Punishment” does a better job explaining it than I do, but I’ll list a few of their reasons here:

- Slippery Slope. Once the mechanism for collecting this tax from the ultra-wealthy is established, it will inevitably be extended to people of lower net worth.

- Valuation. The price of an asset is unknowable before it is sold, and the government would be incentivized to manipulate valuations to the upside by the desire for tax revenue.

- Liquidity. Taxpayers would be forced to liquidate assets in order to pay tax on unrealized gains, and these liquidations would destroy wealth for other people who own shares of the same asset, or assets in the same class.

- Asset Inflation. A tax on unrealized gains gives those with influence over monetary policy the power to directly confiscate the property of private citizens.

- Capital Flight. Wealthy people have the resources to minimize their exposure to any form of wealth tax, even by moving en masse to a new jurisdiction. It has happened before and it would happen again.

- “Capital Punishment.” There’s a saying that governments should “tax what they want to see less of.” As a purely behavioral matter, a tax on capital accumulation discourages wealth building and the deferral of consumption.

- Unspoken Motivation. Taxing unrealized gains would generate only a tiny amount of revenue compared to federal deficits. By process of elimination, the real motivation for this proposal must be punitive in nature.

Conclusion: The Complex Reality of Taxing Unrealized Gains

As we’ve explored throughout this analysis, the debate over taxing unrealized capital gains isn’t simply about “taxing the rich” – it’s about fundamental questions of economic incentives, practical implementation, and long-term consequences.

Key Takeaways:

- Understanding Unrealized Gains

– Paper profits aren’t the same as actual wealth

– Market prices can be misleading at scale

– Current system encourages long-term investment

- Policy Implications

– Harris’s proposal targets ultra-wealthy ($100M+)

– Implementation faces significant practical challenges

– Could affect broader investment behavior - Broader Economic Impact

– May discourage saving and investment

– Could trigger capital flight

– Might set a precedent for broader wealth taxation

Alternative Solutions to Consider:

- Reform collateral lending practices around unrealized gains

- Close existing tax loopholes

- Adjust realized capital gains rates

The path forward likely requires a balanced approach that addresses wealth inequality while preserving incentives for saving and investment. Whether that includes taxing unrealized gains remains an important question for policymakers and citizens alike.

What’s your perspective on this bill? Share your thoughts in the comments below, especially if you see angles I haven’t covered or have experience with similar policies in other countries.