I’ve read 8 Personal Finance books this year and always write notes for myself. I realized that most people could benefit from getting the key takeaways from the book, so I thought I’d start sharing my notes. While I wouldn’t consider these reviews comprehensive and they are definitely not a replacement for reading the book, but it might be enough to give you an idea of whether you want to read the book and as a reference guide once you have.

Without further ado, here’s my summary of the book Die With Zero by Bill Perkins.

Die With Zero Summary

Rating 5/5: 🌕🌕🌕🌕🌕

Your life is the sum of your experiences.

Bill perkins, Die By Zero

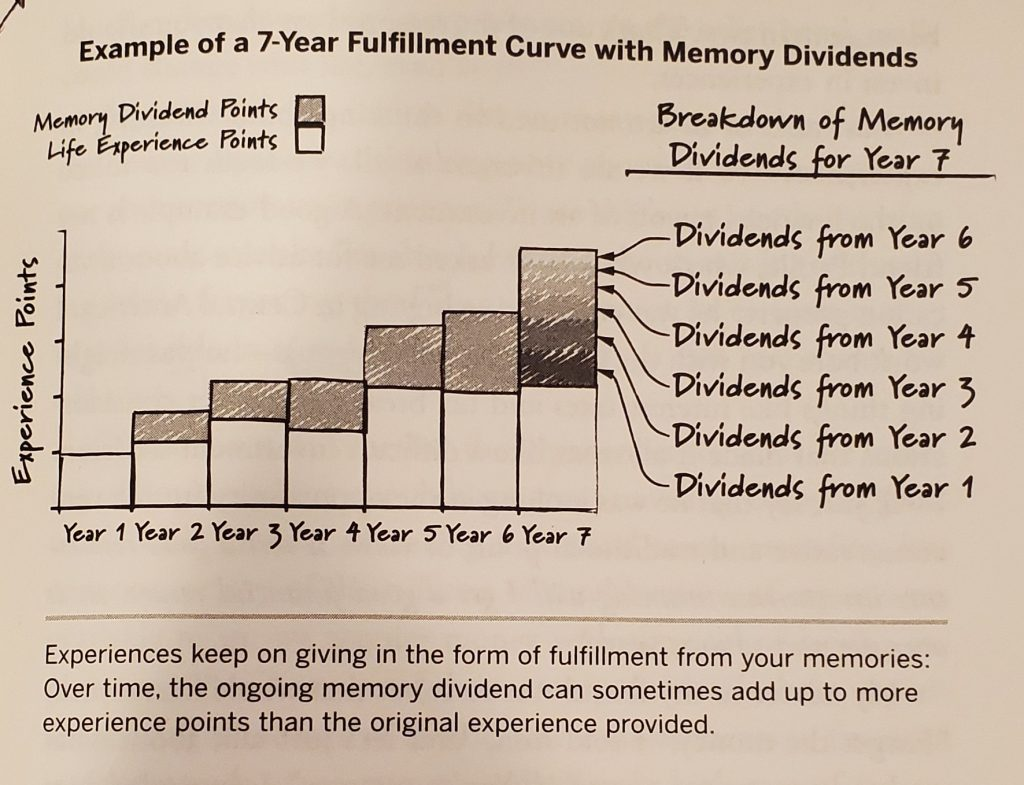

This is the thesis of the book. He defines the “sum of your experiences” as being the same as the memory dividends of your experiences. There are some issues with this concept, but the issues are rather nitpicky, and overall I think this is a good way to think about it. He talks about memory giving dividends (relating it to stocks that give dividends, or small amounts of money every few months.)

If you’re curious, my objections are related to the idea that memories often fade with time, and recalling a memory over and over again will bring back a lower value on future recollections of that memory. It’s like saying a joke for the 100th time isn’t as funny as the first time, so the “dividends” are likely to have decreasing value through time.

This is a very different personal finance book, contrary to many others. The author is a former engineer so it is written from an engineer’s perspective. I believe it would be a great idea to pair this book with any other personal finance book. He talks about various ways to figure and calculate “experience points”, and advocates for withdrawing money much sooner than most so that you aren’t retiring rich, because “you can’t take money to the grave with you.”

Most FIRE books talk about how to live frugally until you have enough money to retire for the rest of your life. Bill Perkins focuses on the point that you shouldn’t be trying to maximize your financial wealth, but your experiential wealth. That means you should spend money to get the best experiences you can and your best experiences might be in the middle of your life, and it’s okay to spend lots of money on really worthwhile experiences.

Along the same line, most FIRE books get you to a point where you can live with relative confidence forever, and his point is that you should start spending sooner so that by the time you reach your death, you have fully used all of your wealth. After all, what is financial wealth for?

He suggests giving with warm hands (give money before you die), so that your heirs can enjoy the money sooner.

He also talks about how to make sure you don’t spend too much, and various insurance tools that can help achieve that goal, but the majority of the time is spent convincing you that you should live life to the utmost (carpe diem, if you will) and how to plan for that.

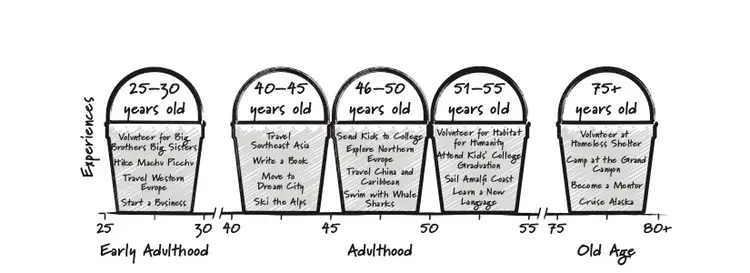

One of my favorite things he talks about is creating a bucket list by age. Write down a list of all the things you would like to finish by the time you die, and then put them in buckets by age. He points out that health declines and so if you want to climb Mt. Kilimanjaro, go sky diving, complete an iron man triathlon, or anything else more physical it makes more sense to try to do those when you can expect good health, then after you’re retired where it may be harder to do the same tasks. Likewise, volunteering for your local humanitarian efforts are easy to do no matter what your age.

Key Takeaways

- Maximize Life Experiences: Prioritize spending on meaningful experiences throughout your life, not just in retirement.

- Time is More Valuable than Money: Recognize that time, health, and energy are finite resources that depreciate with age.

- Die with Zero: Aim to use all your resources by the end of your life, leaving nothing behind except intended inheritances.

- Give with Warm Hands: Transfer wealth to heirs or charities while you’re alive to see the impact.

- Memory Dividends: Invest in experiences that create lasting memories, which provide ongoing returns in life satisfaction.

- Optimize Your Personal Peak: Identify when you’ll have the best combination of health, wealth, and free time for different activities.

- Calculate Your Net Present Value: Consider the value of future experiences and plan accordingly.

- Create a Timeline of Peak Experiences: Map out significant life experiences you want to have and when they’re best enjoyed.

- Balance Saving and Spending: Find the right equilibrium between saving for the future and enjoying life now.

- Reassess Regularly: Continuously evaluate and adjust your financial and life plans as circumstances change.

- Understand Your“Curve of Spending”: Recognize that spending needs typically follow a bell curve over a lifetime.

- Invest in Health: Prioritize health to ensure you can enjoy experiences and resources later in life.

- Use Insurance Strategically: Leverage insurance to protect against risks that could derail your plan.

- Consider Longevity: Plan for a long life, but don’t sacrifice too much of the present for an uncertain future.

Roadmap

Many personal finance books give a roadmap, a step-by-step sequence to how to achieve the goals they talk about.

- Calculate Your‘Net Present Value of Life’

- Estimate your total lifetime earnings

- Subtract necessary expenses and taxes

- This gives you an idea of your ‘life’s worth’ in financial terms

- Create a‘Timeline of Peak Experiences’

- List experiences you want to have in life

- Map these onto a timeline, considering age-appropriateness and physical demands

- Determine Your‘Personal Peak’

- Identify when you’ll have the optimal combination of health, wealth, and free time

- Plan major life experiences around this peak

- Develop Your‘Curve of Spending’

- Map out your projected spending needs over your lifetime

- Typically follows a bell curve, peaking in middle age

- Plan Your Wealth Transfers

- Decide how much (if any) you want to leave as an inheritance

- Plan to give this money earlier rather than later (ideally by age 70)

- Calculate Your‘Die with Zero’ Number

- Estimate how much money you need to fund your experiences and basic needs until the end of life

- This becomes your target, not accumulating maximum wealth

- Optimize Your Spending and Saving

- Adjust your current spending and saving to align with your ‘Die with Zero’ plan

- Increase spending on meaningful experiences if you’re over-saving

- Invest in Health

- Allocate resources to maintaining your health

- This ensures you can enjoy experiences later in life

- Use Insurance Strategically

- Obtain insurance to protect against risks that could derail your plan

- This might include life, health, and long-term care insurance

- Regular Reassessment

- Review and adjust your plan annually

- Consider changes in health, wealth, and life circumstances

- Execute‘Experience Buckets’

- Set aside funds for specific future experiences

- This ensures you don’t defer important life events indefinitely

- Practice‘Equilibrium Spending’

- Continuously balance between enjoying life now and saving for future experiences

- Avoid extreme frugality or excessive spending

Rules

The book’s philosophy could be summarized by these rules.

1. Rule #1 — Maximize positive life experiences. Don’t wait until you retire to start doing stuff you like. Start actively having the life experiences you want to have now. Have lots of meaningful and memorable experiences.

2. Rule #2 — Invest in experiences early. Your life is the sum of your experiences, and when you look back you’ll remember the richness of those experiences. Plan the experiences you want to fit in and start now.

3. Rule #3 — Aim to die with zero. Ideally, you should aim to die with zero — having spent your money on having great personal experiences, taking care of your family, and leaving a legacy. That’s the aim.

4. Rule #4 — Use all available planning tools. You don’t know exactly when you will die, but there are tools available which will give you a rough idea of what your life expectancy is. Use those tools as part of your planning.

5. Rule #5 — Give money to kids/charity early. Give your children whatever you have allocated for them before you die. There’s no point in waiting until you’re gone. That way you can give when it has the most impact on their lives as well.

6. Rule #6 — Don’t live life on autopilot. There are no universal laws when it comes to personal finance and balancing competing demands. Don’t live on autopilot, be prepared to make constant, personalized changes.

7. Rule #7 — Plan in terms of seasons. We all die eventually, and you’ll pass through several stages or seasons before then. Make sure you plan your experiences accordingly, rather than blithely assuming you’ll go forever.

8. Rule #8 — Know when to stop. There is an optimal point at which you should stop working for maximum lifetime fulfillment. Figure out what that is before you blow right past it. Nobody on their death beds wishes they had spent more time at the office.

9. Rule #9 — Take big risks early, not later. The younger you are, the more risks you should be taking, and the bolder you should be. Identify opportunities that pose little risk and go for it. You won’t be able to do this once you get older.