Tax-Free Wealth Book Review

Rating 5/5: 🌕🌕🌕🌕🌕

If you hate taxes like the rest of us, yet know that there is, potentially, a lot of money left on the table if you can figure out the tax law, this book might be for you.

Tom Wheelwright is Robert Kiyosaki’s (of Rich Dad, Poor Dad fame) CPA and accountant and Tom leans heavily on this connection for credibility. Overall, I think this book is fantastic, and one of three books I would recommend to someone in the higher wealth bracket. Tom’s perspective on taxes is inverse to most (he loves taxes) and primarily shifts the concept from taxes penalizing you to making money to taxes as suggestions and incentives from the government on what it wants you to do. If you simply follow their “suggestions”, you will get HUGE tax cuts. He exemplifies this point in the beginning of the book by indicating there are something like 30 pages indicating what should be taxed and an additional 5,970 pages for various exemptions and incentives.

Key Takeaways

Business & Tax Structure

- Business Owners & Investors reap the tax benefits: He uses the Cashflow Quadrant from Rich Dad, Poor Dad and indicates almost all tax benefits are for the right side of the quadrant

- LLC is the asset of choice: This is the go-to for tax savings of almost all kinds and can be a sole-proprietorship, partnership, S-corp, etc.

- Tax law is primarily written to reduce your taxes: 0.5% of the tax law is on raising taxes, and the other 99.5% exist only to save you money

- Taxes are not patriotic: Some people argue that it’s anti-patriotic to try to avoid taxes. Tom thoroughly disproves this, and I’ll summarize with this quote

“Any one may so arrange his affairs so that his taxes shall be as low as possible; he is not bound to choose that pattern which will best pay the Treasury. There is not even a patriotic duty to increase one’s taxes.”

– Judge Learned Hand - Get a tax strategist: They should be working with your banker, lawyer, tax advisor (CPA), bookkeeper, investment advisor, and you

Investment & Tax Benefits

- Roth IRA: Unlike most Personal Finance coaches, he suggests always going for a Roth IRA and planning for a higher retirement later in life

- Depreciation: Tom labels depreciation as the king of all tax deductions. It’s very important to note that real estate investment depreciation only affects passive income

- Assets that work well in a tax-advantaged plan: Plans like IRAs, Roth IRAs, 401Ks, etc. do well with tax liens, hard money loans, stock trading, gold and silver bullion, cryptocurrency

- Assets that don’t work well in a tax-advantage plan: real estate (you lose the depreciation), paintings, collectibles, gold or silver

- Leverage: Tom talks extensively about the proper use of leverage to increase investments — while acknowledging there are strong risks if used incorrectly

Planning and Strategy

- Turn ordinary income into passive income: If you can do this, then things like depreciation and losses can deduce from your ordinary income

- Estate Planning: Three steps to estate planning — 1. Placing assets in trusts, 2. Creating a will, 3. Avoiding the estate tax

- Trading losses: You can use $3,000 a year in capital losses to offset other income

- Prepare for audits: tax audits don’t have to be awful, a good thing to have set is accounting software and corporate books

- Tax cut incentives: Look for where the government is incentivizing by giving tax cuts

Tax Rules (Guidelines)

Tom scatters his tax guidelines (that he calls rules) throughout the book. I’ve listed them all here together.

- It’s your money, not the government’s.

- The tax law is written primarily to reduce your taxes.

- The fastest way to put money in your pocket is to reduce your taxes.

- Everything you do either increases or lowers your taxes.

- The tax law is a stimulus package for entrepreneurs and investors.

- You can deduct

almostanything given the right facts. - It’s not how much you own that matters, it’s how much you control.

- Treat your business just as you would if it were a big public company.

- All tax planning must have a business purpose other than reducing taxes.

- When you want to reduce a tax, reduce the base on which it’s measured.

- Every location has different tax rules, and paying tax in several locations can result in paying less total tax than you would if you did business in only one location.

- To receive the foreign tax credit, the same taxpayer (entity) who pays the tax in the foreign country has to report the income in the home country.

- Taxpayers with long-term, flexible tax strategies will always pay less tax than those without strategies.

- You must maintain control of your assets at all times and in all circumstances.

- Never ever put a tax shelter investment inside another tax shelter.

- The single best tax shelter in most countries’ tax law is investing in rental real estate.

- Mutual funds are one of the few places where you can lose money and still owe tax on your investment.

- The better the tax benefits, the more complicated the rules.

- You can eliminate your fear of a tax audit simply by being prepared.

- Never try to handle a tax audit yourself. Always enlist the assistance of your tax advisor.

- The more passionate you and your advisor are about reducing your taxes, the lower your taxes will be.

- It’s not how much your tax preparer charges you that matters; it’s how much your tax preparer costs you.

How to Implement These Strategies

1. Start with Business Structure

My first step was setting up an LLC and understanding exactly how it could protect my assets and reduce taxes.

2. Build Your Team

I went from just having a CPA to building a comprehensive team. Here’s the order I followed:

- Found a tax strategist

- Hired a lawyer for proper structuring

- Brought in bookkeepers for clean documentation

- Coordinated all team members’ efforts

3. Choose Your Investments

Based on Tom’s guidance, I focused on tax-advantaged investments that matched my business structure. This meant prioritizing certain assets in my IRAs and others in my LLC.

Summary

In most personal finance books I have enough understanding and opinion to have disagreements and other notes. I don’t have that understanding of taxes to have my own opinion, but from my research and reviews of the book, the main criticism is that Tom pushes his own services (on the very expensive side) in various arguments. I have yet to see any disagreements with what he’s written. I’d absolutely recommend this book to anyone who owns a business or has passive income or significant wealth.

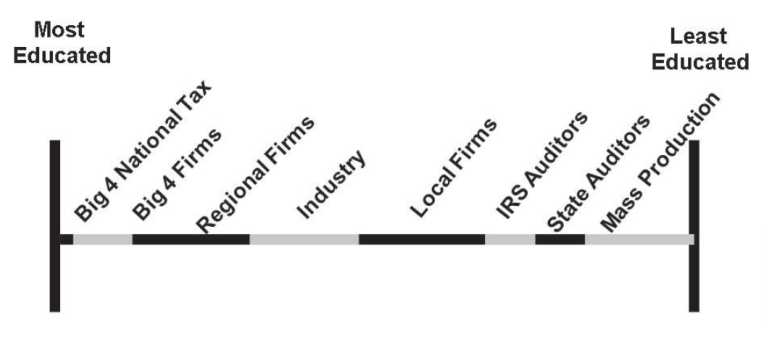

Before this book, I only had a CPA in my tax team. I didn’t understand where that knowledge was on the scale of tax-knowledge professionals, and I assumed tax auditors were the most knowledgeable.

Now, I have my CPA, a lawyer setting up my will, hiring bookkeepers, and engaged in tax strategist advice. I talked to more of my wealthy friends and they all thought these were great actions to take.